NAIROBI (CoinChapter.com) — XRP is under pressure following a sharp drop in market activity and investor confidence. With open interest falling and liquidations mounting, some traders fear the token’s 2025 rally has lost steam. But amid growing speculation around a potential Ripple-Cardano partnership and macroeconomic turbulence, others argue a breakout could still happen—possibly toward $3.40.

XRP Price Slides Despite Rumors of Ripple-Cardano Alliance

XRP traded at $1.87 on Apr. 8, down over 14% in the past seven days and nearly 19% in a month. According to CoinGlass, the token’s open interest dropped from $3.22 billion on Apr. 6 to $2.83 billion the next day, signaling an exodus of capital from XRP markets.

That drop coincided with $59 million in long XRP liquidations, suggesting traders were forced out amid the recent market dip. Short liquidations reached $11.56 million over the same period. The scale mirrors losses in early Feb., when $112 million was wiped from XRP longs as the price plunged from $2.97 to $1.76.

The downturn comes just as speculation mounts over a potential Ripple-Cardano collaboration. A new Ripple video opened with Cardano’s logo while discussing tokenization—a sector projected to hit $18 trillion by 2033. While neither party has confirmed a partnership, the visual cue has ignited debate across the crypto community.

Trump Tariffs, Risk-Off Mood Fuel Volatility in XRP Price

U.S. President Donald Trump’s Apr. 2 announcement of reciprocal tariffs on trading partners further complicated the landscape. The threat of a global trade war sent risk-on assets tumbling, including XRP, which dipped to $1.64 on Monday before briefly rebounding to $1.92.

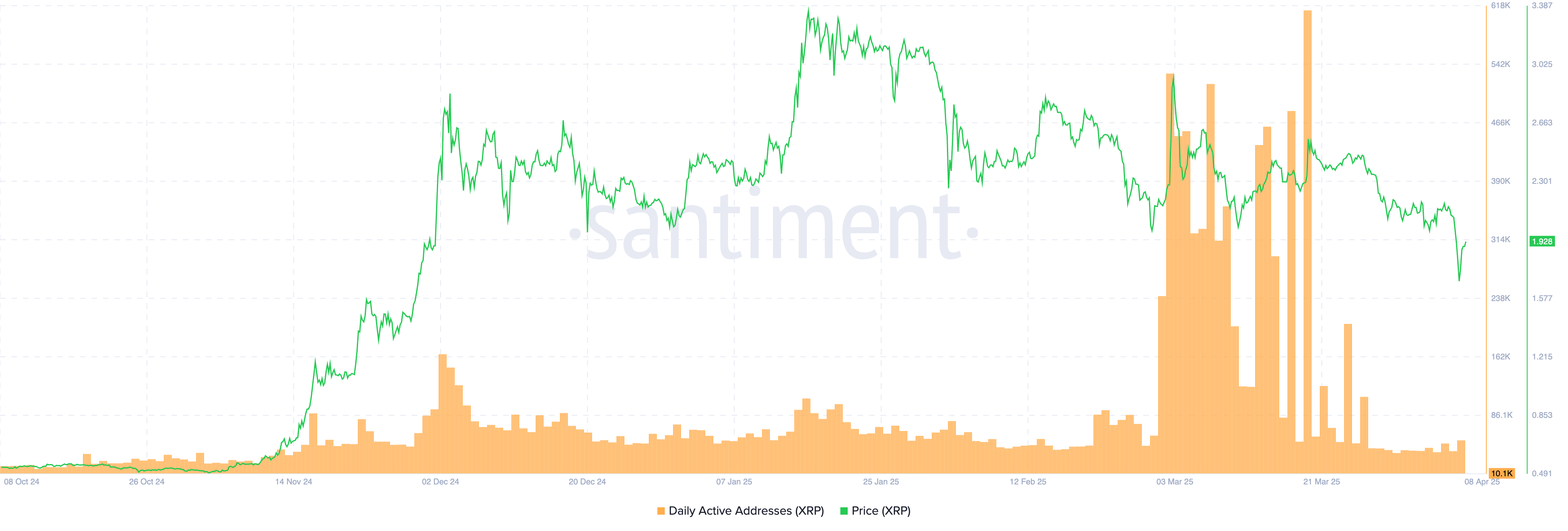

Ripple’s native token is sensitive to geopolitical developments given its cross-border payment focus. Tariff shocks, combined with falling network activity, have eroded short-term demand. Santiment data showed only 10,100 active XRP addresses on Apr. 7—down from 581,000 on Mar. 19.

Meanwhile, XRP’s funding rates in perpetual futures have stayed negative for weeks. Negative funding means short sellers are paying longs to hold positions, indicating market-wide bearish bias. Declining open interest, now 63% below its Jan. 18 peak of $7.8 billion, supports this sentiment.

Analyst Views Remain Split Despite Bearish Technicals

Crypto analyst Ali Martinez remains cautiously optimistic, noting XRP has broken out of a head-and-shoulders pattern, which could open the door to $1.30. However, that target still lies below the current spot price.

Crazy Buddha described XRP’s current triangle pattern as a prelude to a trend shift. “The market pullback is just setting up for a stronger rally,” the trader claimed in a post on Apr. 7.

More aggressively bullish was Egrag Crypto, who suggested XRP could rally to $27 in the next six months. “The Kangaroo will jump,” he posted, referencing similarities between current candle formations and XRP’s 2017 breakout. Egrag highlighted $2 as a “safest foundation” for the FOMO phase.

AMcrypto echoed this level’s importance. “XRP is holding its $2 support level pretty well,” he posted Saturday, adding that a breakout above $2.30 would be crucial for upside momentum.

On-Chain Metrics Hint at Undervaluation—But Bears Still in Control

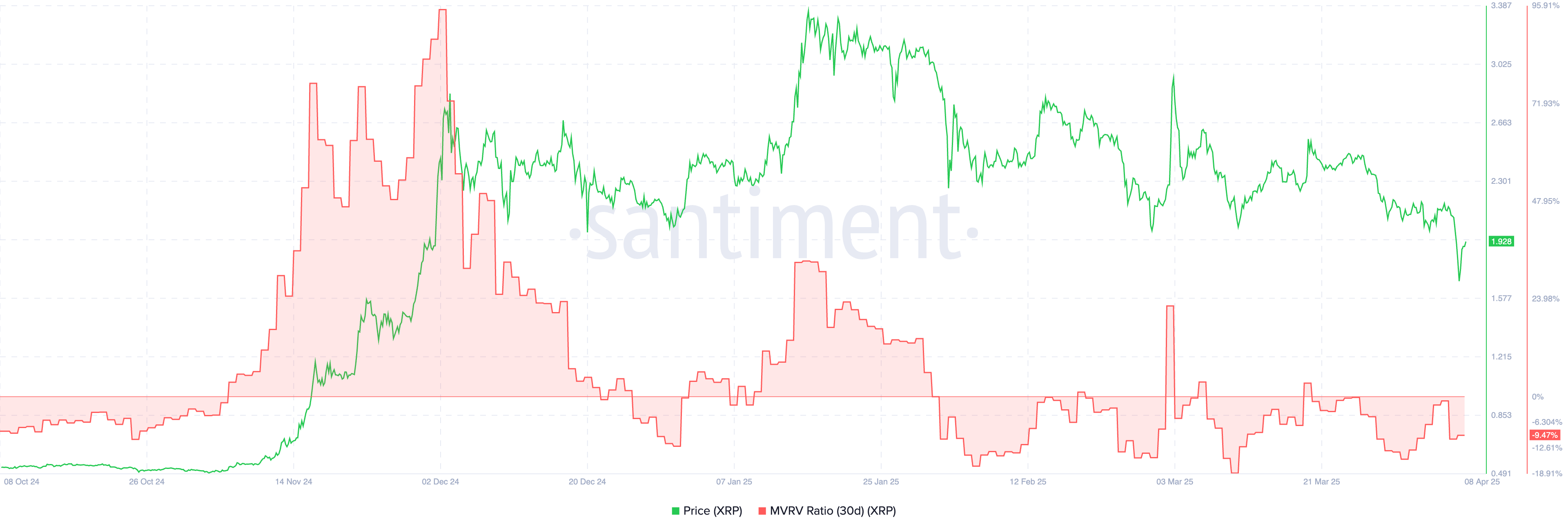

Santiment’s Market Value to Realized Value (MVRV) ratio stands 9.47% below its mean, a level historically associated with undervaluation. However, the token’s recovery has stalled as investors remain hesitant to reenter.

XRP would need to reclaim the $2.08–$2.62 range, where over 70% of volume occurred between Dec. 2 and Apr. 12, to regain bullish structure. The MACD continues to flash a sell signal while the RSI trends lower, adding weight to bearish projections.

Still, if demand returns and XRP breaks through the $2.41 volume node, the next key level is $2.62. Beyond that, the previous all-time high of $3.40 becomes the next milestone.

While XRP bulls hold onto hope that tokenization plays or macro relief could trigger a rebound, the data paints a cautious picture. Declining network activity, weak technicals, and macroeconomic headwinds weigh on near-term prospects.

However, with speculation mounting around Ripple and Cardano, and on-chain signals pointing to undervaluation, XRP’s next move could still surprise both bears and bulls. Above all, for now, reclaiming $2 remains the first test.