YEREVAN (CoinChapter.com) — Bo Hines, head of the Presidential Council of Advisers on Digital Assets, confirmed the Trump administration is considering tariff revenues to fund a national Bitcoin Reserve.

In a recent interview with Thinking Crypto, Hines said the idea of creating a Strategic Bitcoin Reserve (SBR) is part of a broader U.S. economic strategy. The plan marks a shift from earlier proposals that relied on gold sales.

“There is a finite number of Bitcoin and I think there will end up being a race to accumulate,”

said Hines. He explained that the U.S. needs to act quickly as global competition for Bitcoin intensifies.

Bo Hines Outlines Bitcoin Strategy in Interviews

In an extended interview with Anthony Pompliano, Bo Hines outlined how the Strategic Bitcoin Reserve fits into the Trump administration’s broader economic strategy. He described the Bitcoin Reserve as a “budget-neutral” initiative, meaning it would not rely on new taxes or borrowing. Instead, it would use existing revenue streams such as tariffs.

Hines said tariff revenues are under consideration because they provide a steady, controllable source of funding. He placed Bitcoin, tariffs, and gold at the center of the administration’s new approach. This mix of traditional and digital assets, according to Hines, reflects the need to adapt national reserves to the current financial climate.

“The strategic reserve is just the beginning,”

said Hines.

“We’re thinking long-term about what assets can empower the American people and insulate us from global shocks.”

Hines pointed out that Bitcoin is not being treated as a speculative asset. Instead, the Trump administration views it as a strategic instrument that could support national stability. The Strategic Bitcoin Reserve, he explained, would function much like traditional reserves, such as those held in gold or foreign currency.

In the same interview, Bo Hines confirmed that stablecoin legislation is also under review. He said there is an active push to integrate blockchain systems into U.S. banking infrastructure. This integration, he claimed, would help modernize financial oversight and assist law enforcement in tracking digital transactions more efficiently.

The plan to use blockchain and stablecoins aligns with the administration’s digital asset framework. Hines presented it as part of a coordinated push to modernize how the federal government handles currency, reserve assets, and financial compliance tools.

Bitcoin Reserve Plan Sparks Mixed Reactions

The idea of using tariff revenues for the Bitcoin Reserve drew attention across the crypto sector. Influencer Crypto Rover shared support on X, while Cardano founder Charles Hoskinson raised doubts about the tariff model.

Charles Hoskinson raised concerns that the Trump administration’s tariff-based Bitcoin Reserve plan could create unintended consequences for the U.S. crypto sector. In a CNBC interview Hoskinson said aggressive tariff policies may increase the cost of importing specialized mining equipment, most of which is manufactured in Asia. He warned that this could undermine the competitiveness of U.S.-based Bitcoin mining firms by reducing access to essential hardware and raising operational expenses. Hoskinson also questioned whether new crypto-focused taxes introduced alongside tariffs would have any real impact, calling them “largely ineffective” due to the decentralized nature of digital assets and the ease with which capital moves across borders.

Some analysts also noted that trade restrictions could make it harder for miners to access Chinese equipment. That could shift the industry landscape, especially for firms dependent on low-cost imports.

Lummis Gold Swap Plan Differs From Hines Proposal

Bo Hines’s approach to building a Bitcoin Reserve differs sharply from the path proposed by Senator Cynthia Lummis. At the Bitcoin 2024 Conference, held in July last year, Lummis introduced a legislative plan to convert part of the Federal Reserve’s gold reserves into Bitcoin. She proposed liquidating excess gold held at all 12 regional Federal Reserve Banks over a five-year period.

“We will convert excess reserves at our 12 Federal Reserve banks into bitcoin over five years. We have the money now,”

Lummis told the audience.

Her plan focused on reallocating existing federal assets rather than depending on future revenue. The strategy would have shifted the reserve balance away from gold and into digital assets, signaling a symbolic and financial pivot at the federal level.

This distinction highlights two different economic strategies—Lummis’s proposal relies on asset reallocation, while Hines promotes a budget-neutral approach that uses current income streams. Both aim to expand U.S. crypto reserves but operate through fundamentally different mechanisms.

Trump Administration Eyes Broader Digital Asset Shift

Reports indicate that the Trump administration is preparing to interview candidates to potentially replace Federal Reserve Chair Jerome Powell. Powell’s term concludes in May 2026. U.S. Treasury Secretary Scott Bessent stated that the White House plans to begin the interview process this fall. This would provide approximately six months to identify a successor. This development follows President Trump’s public calls for the Federal Reserve to lower interest rates, as expressed in an April 4 post on Truth Social. Bessent emphasized that while he is not concerned about the administration undermining the Fed’s independence, there is room for discussion regarding the Fed’s role in bank regulation. He highlighted the importance of distinguishing between the Fed’s monetary policy responsibilities and its regulatory functions, noting that the Federal Reserve shares regulatory duties with the Office of the Comptroller of the Currency and the FDIC.

Bo Hines hinted that the Strategic Bitcoin Reserve is just one part of a wider plan. This includes legal frameworks for stablecoins, blockchain integration into banking, and tools to improve crypto enforcement.

These changes are linked to the administration’s broader U.S. economic strategy. Tariff revenues, digital assets, and strategic reserves are being positioned as parts of a national framework.

Bitcoin Price Stable During Reserve Talks

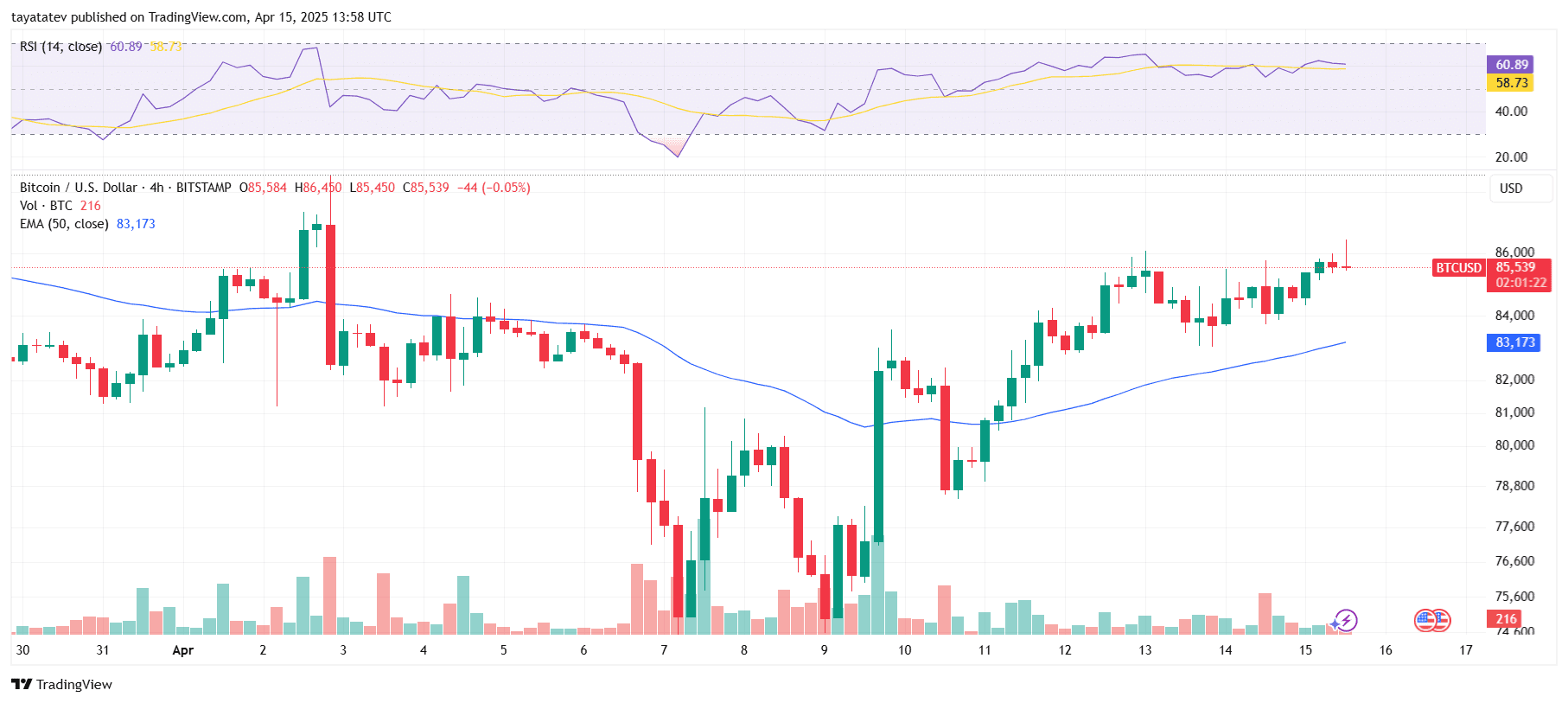

Bitcoin (BTC) traded at $85,539 on April 15, 2025, according to 4-hour data from Bitstamp. The price was nearly flat. It showed a 0.05% decline from the previous candle, despite a brief intraday spike to $86,450. The move followed steady accumulation over the past three days. This pushed Bitcoin above the 50-period Exponential Moving Average (EMA), currently at $83,173.

Volume remained moderate, with 216 BTC traded during the latest 4-hour session. The Relative Strength Index (RSI) hovered at 60.89, staying below overbought conditions and suggesting neutral momentum.

Despite public attention on the proposed Strategic Bitcoin Reserve and broader macro policy changes, BTC price action stayed within a tight range. The market reaction suggests traders are waiting for clearer signals related to tariff policy, Federal Reserve leadership changes, and crypto regulation before making larger directional moves.