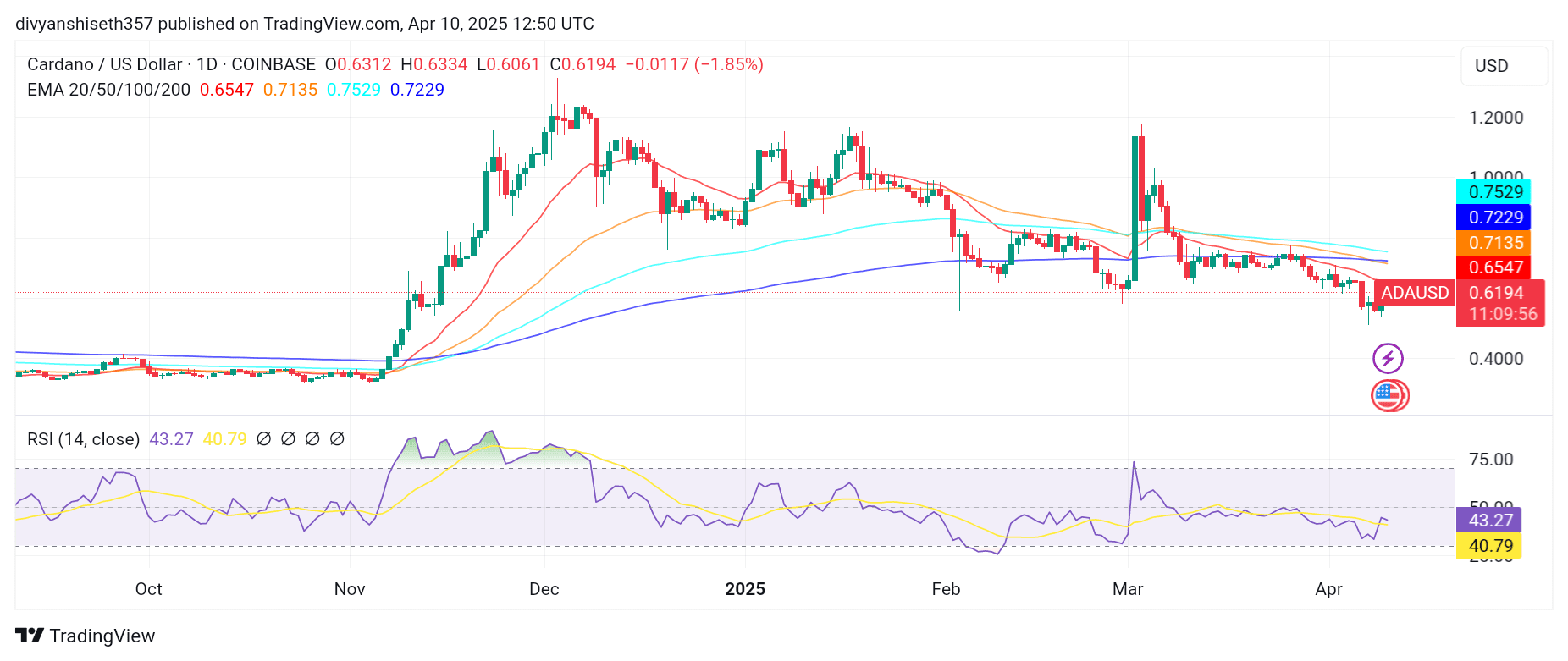

Technical indicators for Cardano’s native token ADA suggest a possible breakout in the current cycle. As of April 10, ADA is trading at $0.6258, up 9.18% in the last 24 hours. The price movement comes amid a modest pullback in volume—down 7.61% to $1.36 billion—but a strong increase in market cap, now standing at $21.92 billion.

Pattern Projects Token to Capture 3.5% Market Share

One of the more compelling signals comes from a long-term pattern seen in ADA’s market dominance chart. A classic head and shoulders formation appears to be developing—a pattern often associated with breakout movements when confirmed.

This formation includes a neckline, two similar-sized shoulders, and a central peak or “head.” In technical analysis, the vertical distance from the neckline to the top of the head is used to estimate the potential upside target. Applying this logic to ADA’s dominance chart points to a possible rise to 3.5% market share in the overall crypto ecosystem.

If total crypto market capitalization were to grow to $5 trillion—a figure often cited in optimistic market projections—a 3.5% share for Cardano would place its market cap at approximately $175 billion. Given ADA’s current circulating supply, this would translate to a price north of $5 per token.

While this scenario assumes both a bullish market and a strong position for Cardano, the numbers align with historical breakout behaviors observed in past cycles.

You May Also Like: Cardano founder Charles Hoskinson Brutally Thrashes Solana Memecoins

Pattern Repeats: Is It ADA’s Turn?

The current pattern closely resembles historical movements from earlier cycles. In 2021, similar dominance structures triggered sharp price expansions. That repetition alone doesn’t guarantee the same outcome, but it does increase interest among technical traders and long-term investors.

The weekly Relative Strength Index (RSI) for ADA stands at 46.11, below the neutral 50 mark, but showing upward momentum. This suggests that while the token is not yet in overbought territory, a shift in sentiment could drive further gains.

ADA is finding some support near the $0.60 level, which has acted as a recent price floor. If this level breaks, the next key support could be around $0.50, a zone where buyers may look to step in. On the upside, the first resistance is around $0.65, near the 20-day EMA. A stronger barrier exists between $0.71 and $0.75, where the 50-day and 100-day EMAs are positioned. These levels will likely be difficult for the price to cross unless market sentiment improves..